Background on SpaceX and EchoStar

SpaceX, founded in 2002 by Elon Musk, has transformed the aerospace industry with its innovative approach to space exploration and satellite technology. The company’s mission is centered around reducing space transportation costs and enabling the colonization of Mars. Over the years, SpaceX has achieved numerous milestones, including the first privately funded spacecraft to reach orbit and the first re-flight of an orbital class rocket. These accomplishments not only demonstrate the company’s expertise in satellite launches but also underscore its commitment to revolutionizing access to space.

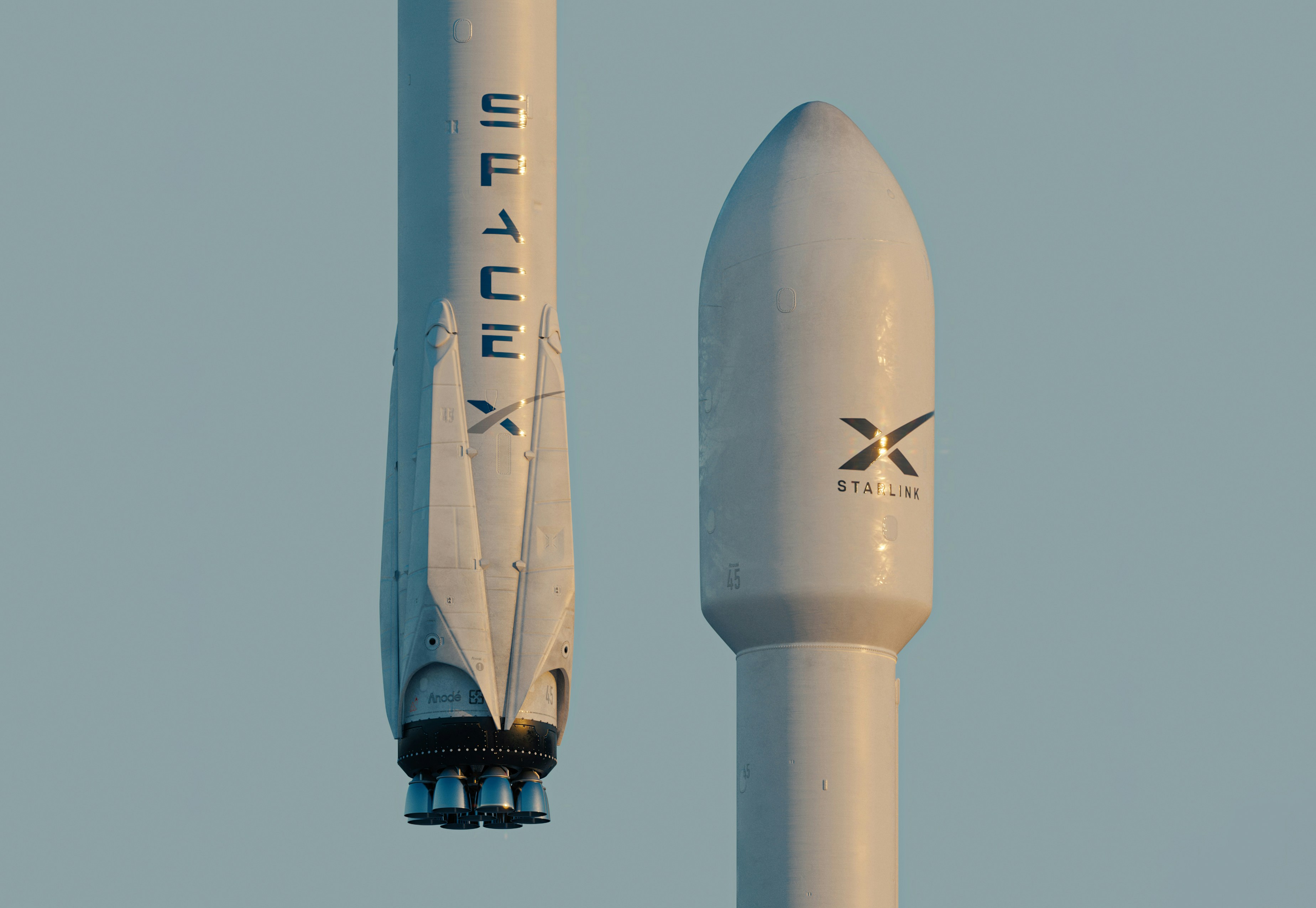

One of the most significant contributions of SpaceX to the satellite sector has been through its Starlink project, which aims to provide global satellite internet coverage. The company has launched thousands of small satellites into low Earth orbit, creating a vast network designed to deliver high-speed internet access, particularly in underserved regions. Starlink exemplifies how SpaceX has leveraged its technological advancements to disrupt traditional telecommunications models while enhancing global connectivity.

On the other hand, EchoStar, established in 1980, operates primarily within the satellite communications realm, providing services that range from direct-to-home television to broadband internet solutions. The company’s diverse portfolio includes a fleet of satellites that deliver services across the globe. EchoStar’s significance in the telecommunications sector is largely attributed to its extensive spectrum holdings, which are crucial for facilitating the transmission of data for various communication services. The company has consistently focused on expanding its capabilities and user reach, maintaining a competitive edge in a rapidly evolving market.

Understanding the historical and operational landscapes of both SpaceX and EchoStar provides vital insights into the strategic implications of the recent $17 billion acquisition of EchoStar’s spectrum by SpaceX. This acquisition highlights the increasing convergence between space technology and telecommunications, emphasizing the evolving nature of service delivery in an increasingly connected world.

The Spectrum Acquisition Deal

On October 15, 2023, SpaceX announced its acquisition of spectrum licenses from EchoStar for an estimated $17 billion, marking a significant maneuver in the telecommunications sector. This acquisition includes a range of frequencies that are highly sought after for satellite communications. The agreement allows SpaceX to utilize the spectrum, which is crucial for its Starlink project as well as potential future ventures that rely on robust satellite connectivity. The specific frequencies involved in this transaction are those covering both Ka-band and Ku-band, which are ideal for high-speed broadband services.

The terms of the deal stipulate certain licensing conditions that must be addressed before finalizing the transaction. These conditions include regulatory approvals necessary from the Federal Communications Commission (FCC) and other governing bodies. SpaceX has indicated its commitment to expeditiously comply with these requirements, aiming for a seamless transition of the spectrum licenses. The anticipated timeline for completion is projected to fall within the next 18 months, contingent on the acquisition’s regulatory review process.

Negotiations for this significant acquisition unfolded over several months, with both parties recognizing the growing importance of satellite communications in today’s digital age. The deal is seen as a strategic effort by SpaceX to bolster its competitive edge in the satellite internet market, particularly as demand for global broadband coverage continues to surge. Furthermore, experts suggest that this acquisition could reshape the telecommunications landscape by enhancing service offerings and promoting technological advancements in satellite communications. Overall, the SpaceX and EchoStar spectrum deal signifies a major step towards expanding high-speed internet access across expansive regions, providing a potential foundation for future developments in satellite technology.

Strategic Implications for SpaceX and the Industry

The recent acquisition of EchoStar’s spectrum by SpaceX for a remarkable $17 billion has significant strategic implications for both the company and the broader satellite and telecommunications industry. By obtaining this valuable spectrum, SpaceX is poised to enhance its Starlink project, which aims to provide global broadband services. This acquisition substantially increases SpaceX’s capacity to expand its satellite constellation, allowing for improved coverage and higher data speeds for users around the world.

The technical advantages are clear; the eligibility of EchoStar’s spectrum for low Earth orbit (LEO) systems means that SpaceX can leverage this license to bolster its current operations. Enhanced bandwidth translates to more robust user experiences, especially in underserved regions where traditional broadband access is either sparse or non-existent. Industry analysts predict that with the integration of EchoStar’s technology, Starlink could minimize latency significantly, making it a formidable competitor against established internet service providers.

The ramifications of this acquisition extend beyond SpaceX, as it introduces a potential disruption to established business models within the satellite and telecommunications sectors. Competitors are likely re-evaluating their strategies in response to the heightened capabilities of SpaceX. The ability to provide affordable, high-speed internet globally, backed by a powerful spectrum portfolio, places SpaceX in a strategic advantage that may force rivals to shift their focus to innovation and cost-efficiency.

Market experts suggest that this acquisition could lead to increased consolidation in the telecom industry, where companies may seek mergers or partnerships to remain competitive. Furthermore, the regulatory landscape may also see scrutiny as the implications of this acquisition unfold. As SpaceX integrates EchoStar’s spectrum into its operations, the effects on pricing, service accessibility, and overall market dynamics will be closely monitored by industry stakeholders.

Looking Ahead: The Future of Satellite Communications

As SpaceX acquires EchoStar’s spectrum for a substantial $17 billion, the landscape of satellite communications is poised for significant transformation. This acquisition may catalyze the evolution of satellite internet services, enhancing coverage and speeds for consumers. The integration of EchoStar’s resources with SpaceX’s existing Starlink constellation could lead to improved bandwidth capabilities, allowing for more robust data transmission and an expanded user base. With the increasing reliance on internet connectivity, especially in remote areas, the demand for high-quality satellite internet services is expected to surge.

The growth of the space economy is another pivotal factor to consider. With industry players like SpaceX leading the charge, investment in satellite technology is anticipated to accelerate, fostering innovation and competitiveness. The entry of new players in the market could further diversify service offerings, benefitting consumers with enhanced choices and pricing structures. As SpaceX continues to innovate in this domain, we may witness advancements in satellite technologies such as low-orbit satellites, which promise reduced latency and improved service quality.

However, the acquisition also raises potential regulatory challenges that could affect the satellite communications sector. Governments and regulatory bodies will likely scrutinize the consolidation of spectrum ownership to ensure a competitive marketplace. This scrutiny might lead to new regulations aimed at maintaining equitable access and preventing monopolistic practices. As SpaceX navigates these regulatory landscapes, the response from competitors will also be crucial in shaping the market dynamics.

Looking toward the future, the satellite communications industry may experience an influx of cutting-edge trends and innovations. These could include advancements in direct-to-device communications, facilitating connectivity without intermediary networks, and the integration of artificial intelligence in satellite operations. The interplay of these developments could redefine consumer access to broadband and significantly enhance global communications.